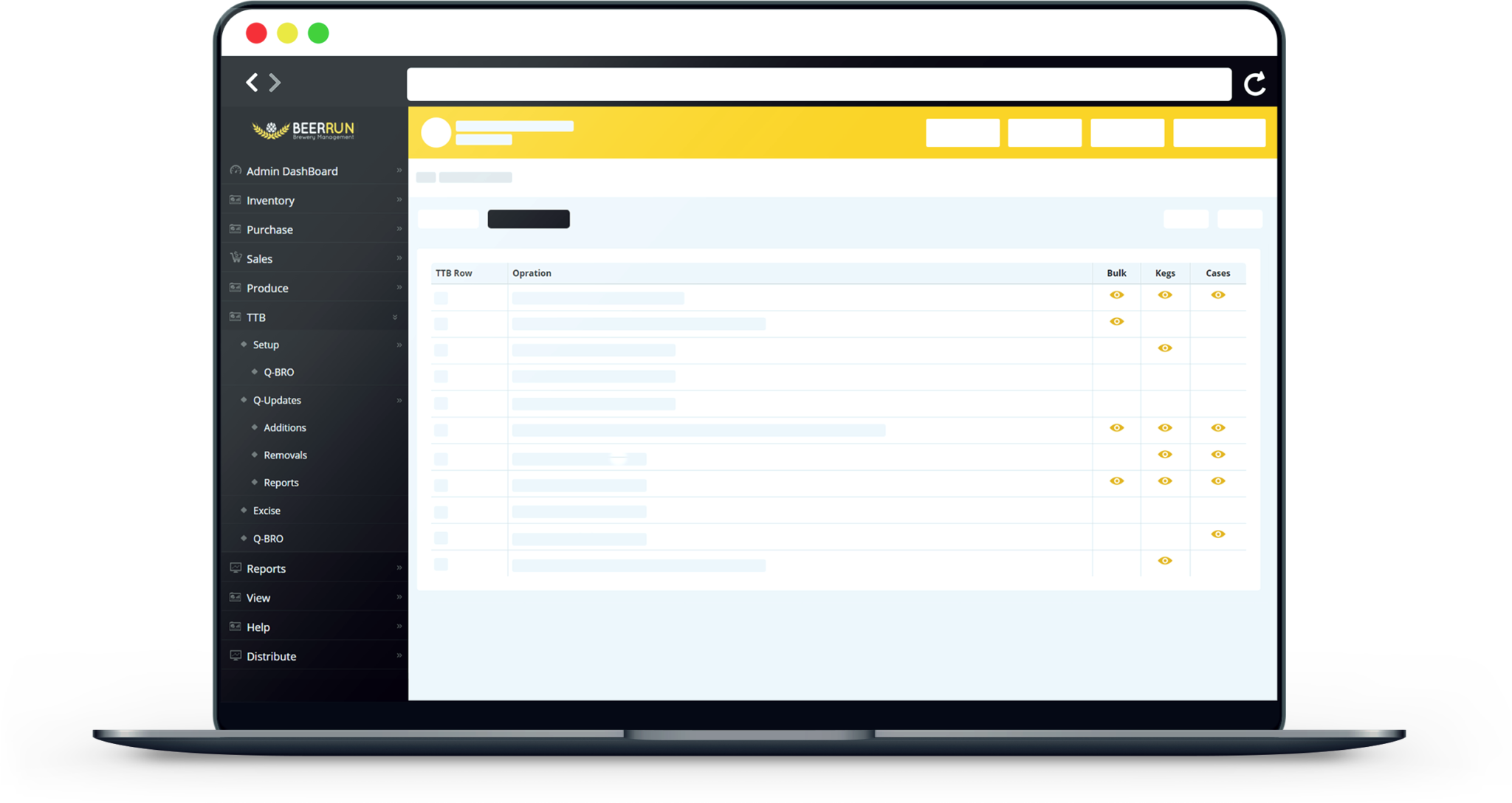

Tax Reporting

With a single click, produce each Federal Excise report, Report of Operations and State/Provincial report with full supporting documentation; and print or upload:

- Captured on the fly; no button to be pressed

- Automatically computes Excise based on invoices (for production breweries) or fermentation (for brewpubs)

- Select payment method and auto-compile Excise tax return; print or upload to TTB at pay.gov

- Auto-compile Brewer’s/Brewpub Report of Operations (monthly or quarterly); print or upload to TTB at pay.gov

- Manual updates (beer received and transferred)

- View all Excise payments made

- Your State report (US) or Provincial report (Canada) is included as standard functionality; additional reports are available

- View all supporting documentation at any time in PDF format

Recent Comments